Corporate Governance

Basic Policy on Corporate Governance

Chapter 1 General Provisions

- Purpose

This basic policy sets out the basic framework and operational policy concerning the corporate management and governance of the Kumiai Chemical Group (the Group) with the aim of helping to maximize the Group’s corporate value. -

Corporate Philosophy

<Kumiai Chemical Group Corporate Philosophy>

We will contribute to the safety, security, and prosperity of society by leveraging our unique scientific creativity to protect and foster life and nature.<Group Principles>

- Service to society

- Innovation and ingenuity

- Positivity and resolve

- Understanding and trust

Chapter 2 Relationship with Shareholders

- General Meeting of Shareholders

(1) We recognize that the General Meeting of Shareholders is the company’s highest decision-making body and ensure substantial equality of shareholders and appropriate opportunities to exercise their rights at the General Meeting of Shareholders.

(2) Kumiai Chemical Industry (the Company) treats all shareholders equally in proportion to their shareholdings, and discloses information in a timely and appropriate manner, ensuring there are no disparities in information provided to different shareholders.

(3) To ensure that shareholders have sufficient time to review the proposals of the General Meeting of Shareholders and are able to exercise voting rights appropriately, the Company sends the notice of convocation for the Ordinary General Meeting of Shareholders earlier than the statutory deadline and posts it on its corporate website before it is sent.

(4) In order to enable the electronic exercise of voting rights by institutional investors and overseas investors, we participate in a platform for electronic exercise of voting rights. In addition, we translate the notice of convocation into English and publish it on the corporate website to increase convenience for overseas investors.

(5) In the event that a substantial number of votes are cast against a proposal that is approved at a General Meeting of Shareholders, it is reported to the Board of Directors after an analysis of the causes. If necessary, dialogue with shareholders is considered. - Policy on Capital Measures

(1) The Company maintains a level of shareholders’ equity that enables flexible growth investment and allows for the risks associated with business activities. We also aim to build a solid financial base that enables stable procurement of funds without being affected by changes in the environment.

(2) With regard to shareholder returns, we consistently provide stable dividends based on a comprehensive consideration of consolidated performance in each fiscal year, the payout ratio, cash on hand, internal reserves, and future investment plans among other factors. - Policy on Cross-Shareholdings

(1) The basic policy is to reduce the Company’s cross-shareholdings gradually. The Board of Directors carefully examines the rationale for holding individual stocks and verifies the appropriateness of holdings each year.

(2) The significance of holdings is verified in terms of the medium- to long-term economic rationale based on risks and returns, including synergies in the Company’s business, dividends, and earnings from related transactions. In addition, it is also checked whether a holding is in line with advantages of maintaining and strengthening business relationships with investees or promoting joint business, or other holding purposes. We continue to hold stocks for which the rationale is confirmed through the verification described above and consider selling stocks for which the rationale is not confirmed.

(3) We have established the screening criteria set out below for the exercise of voting rights. For applicable stocks, we decide on approval or disapproval of proposals after examining the proposal.

(Screening Criteria)

(a) Significant decline in share price;

(b) Significant deterioration in business performance;

(c) Legal violations or anti-social conduct;

(d) Other cases of significant impairment of the corporate value of the Company or the investee company, etc.

- Policy on Takeover Defense Measures

The Company has not introduced any takeover defense measures. Therefore, in the event that the Company’s shares are the subject of a takeover bid, we will request the bidder to explain its measures for enhancing the corporate value of the Group and promptly disclose the position of the Board of Directors. - Policy on Related Party Transactions

Transactions involving conflict of interests and competitive transactions between the Company and a director or directors are discussed with the Board of Directors in accordance with the Companies Act and the Rules of the Board of Directors. - Dialogue with Shareholders

In order to promote constructive dialogue with shareholders, the Company has established an investor relations (IR) system led by the officer in charge of IR, and actively responds to information requests from major shareholders and investors. More specifically, the Company communicates with shareholders and investors through financial results presentations, small meetings, business site tours, individual IR interviews, issuance of shareholder bulletins, and corporate reports by third party institutions.

Chapter 3 Collaboration with Stakeholders

- Collaboration with Stakeholders

The Company recognizes shareholders, customers, suppliers, creditors, local communities, and employees as stakeholders. We cooperate appropriately with stakeholders to achieve sustainable growth for the company and create corporate value over the medium to long term. - Sustainability

Based on our Medium-Term Management Plan, which takes a long-term perspective as we aim to become a 100-year-old company, we seek to solve social issues by further strengthening our ties with stakeholders to create new value together through our business operations (products and services). At the same time, in accordance with our Basic Policy on Sustainability, we promote initiatives that contribute to sustainability management to help build a sustainable world. - Promotion of Diversity

The Group promotes measures to make the most of diverse human resources in accordance with our Basic Policy on Human Resources Management. - Internal Reporting System

The Group has established an internal consultation desk and the Group external consultation desk (contracted to a specialized company). We operate the internal reporting system in accordance with the Internal Reporting System Rules.

Chapter 4 Information Disclosure

- Approach to Information Disclosure

The Group recognizes that enhancing information disclosure is a prerequisite for constructive dialogue with shareholders and investors. We make disclosures in compliance with the Timely Disclosure Rules stipulated by the Tokyo Stock Exchange. In addition, we proactively and impartially disclose on our corporate website other information, not subject to the Timely Disclosure Rules but which is considered to be effective for understanding the current status of the Group from the perspective of shareholders and investors, such as plans related to the management base or business strategy. - Disclosure of the Basic Policy on Internal Control

The Board of Directors resolves on the Basic Policy on the System for Ensuring the Appropriateness of Operations (Internal Control System) and Basic Policy on Internal Control over Financial Reporting, which it discloses in a timely and appropriate manner.

Chapter 5 Corporate Governance System

- Governance System

(1) The Company has adopted the “Company with an Audit & Supervisory Board” corporate governance framework. The Board of Directors, of which at least one third of the members are independent outside directors, determines management policy, makes important management decisions, and strengthens the supervisory function for business execution. The Board of Directors performs these roles while working closely with the Audit & Supervisory Board, of which a majority of the members are outside Audit & Supervisory Board members, to make effective use of the functions of the Audit & Supervisory Board members in order to maintain and improve a corporate governance system that is highly transparent for stakeholders.

(2) The Company has clearly separated responsibilities for management functions and business execution and has adopted an executive officer system from the perspective of enhancing business execution functions and increasing the speed of decision making.

(3) In pursuit of fair Group management, we pursue consolidated management through mutual cooperation in accordance with the Affiliated Company Management Rules and the corresponding Rules on the System of Cooperation with the Parent Company at individual companies. At the same time, we instill the Corporate Philosophy, share management strategy and management policy, and comprehend the status of management through the Kumiai Chemical Group Top Management Strategy Meeting to implement corporate governance with the aim of maximizing Group-wide value. - Directors and the Board of Directors

(1) As a body entrusted by the General Meeting of Shareholders, the Board of Directors makes decisions based on comprehensive judgement, including the perspective of ensuring the common interests of the company and shareholders, in accordance with the Companies Act and the Rules of the Board of Directors.

(2) The effectiveness of the Board of Directors is evaluated once a year, and the analysis and results of the evaluation are used to further enhance the functions of the Board of Directors.

(3) The Board of Directors is composed of diverse human resources who understand the Corporate Philosophy, management vision, and corporate culture, and possess the character, insights, and capabilities to serve as directors of the Company. In addition, we have established a highly transparent corporate governance system and appoint independent outside directors as at least one third of the directors in order to ensure the effectiveness of objective supervision of management. - Audit & Supervisory Board Members and the Audit & Supervisory Board

(1) As an independent body that has received a mandate from shareholders, Audit & Supervisory Board members actively exercise this authority to ensure the sound and sustainable growth of the Group, in addition to excellent corporate governance that lives up to social trust. The Audit & Supervisory Board members provide their opinions appropriately at meetings of the Board of Directors or to the management team, in addition to being responsible for overseeing the execution of duties by the directors.

(2) The Audit & Supervisory Board audits whether the accounting auditor maintains a fair and impartial attitude and an independent position and conducts appropriate audits as a professional expert in accordance with the Code of Audit and Supervisory Board Member Auditing Standards to ensure the appropriateness and reliability of accounting audits.

(3) If the Audit & Supervisory Board members receive a report from the accounting auditor concerning misconduct or a material fact in violation of laws, regulations or the Articles of Incorporation in the execution of the duties of the directors, they undertake the necessary investigation after deliberation at a meeting of the Audit & Supervisory Board and take the measures that are needed, including providing advice or recommendations to the Board of Directors concerned.

(4) The Audit & Supervisory Board members maintain close collaboration with the Internal Audit Office and conduct organized and efficient audits. - Independent Outside Officers

(1) The Company’s independent outside officers supervise management and business execution. They also use their unique expertise to provide unfettered advice on management policy, improvement of management, and other opinions, as well as points of view that are useful from the perspective of stakeholders, including minority shareholders.

(2) The Company’s criteria for appointing outside directors and outside Audit & Supervisory Board members as independent officers are as set out in Appendix 1. - Establishment of the Nomination and Remuneration Committee

(1) In order to ensure the objectivity and transparency of management, the representative director & president of the Company submits proposals related to the nomination and remuneration of directors to the Nomination and Remuneration Committee. The committee has a total of five members, consisting of the president; one full-time director selected by resolution of the Board of Directors; and three independent outside directors. Based on the advice and recommendations of the committee, the Board of Directors deliberates and makes decisions.

(2) Succession planning for the president is based on full consideration of character, insight, and capabilities of candidates. The Board of Directors determines the candidate who should succeed the president based on advice and recommendations from the Nomination and Remuneration Committee on development of human resources who can exhibit leadership in management to further enhance corporate value. - Accounting Auditor

(1) The Board of Directors and the Audit & Supervisory Board recognize that the accounting auditor plays an important role in ensuring the reliability of the Group’s financial reporting. The Board of Directors, the Audit & Supervisory Board, and the Internal Audit Office cooperate in taking the appropriate action to ensure that accounting auditors conduct adequate, proper audits in an independent and expert manner.

(2) If the accounting auditor observes any deficiencies in tax reporting, the officer in charge of finance is responsible for addressing such deficiencies. - Support Systems for Outside Directors and Outside Audit & Supervisory Board Members

(1) In order to encourage active, constructive discussions at the Board of Directors, an administrative office has been established in the Corporate Planning & Coordination Division to manage the following systems.

(a) Based on the matters deliberated upon during the fiscal year, the schedule for the meetings of the Board of Directors and the matters expected to be deliberated on are finalized by the end of the previous fiscal year.

(b) The materials for the meetings of the Board of Directors are distributed in advance with plenty of time to allow them to be considered.

(c) The time duration for discussion on the day of meetings is set appropriately to allow adequate time for deliberations.

(d) The administrative office provides the necessary information to directors and Audit & Supervisory Board members, including outside directors and outside Audit & Supervisory Board members as required, in addition to providing preliminary explanations as needed.

(2) In order to strengthen the audit function of the Audit & Supervisory Board members, company staff serve as assistants to provide them with operational support.

(3) When directors and Audit & Supervisory Board members execute their duties, the Internal Audit Office and other executive bodies respond positively when requested to provide necessary information. - Policy on Training for Directors and Audit & Supervisory Board Members (Training Policy)

The Company has established a system for directors and Audit & Supervisory Board members to improve their competency. We provide external training opportunities for directors and Audit & Supervisory Board members to learn the basic knowledge required to perform their duties and support for them to deepen their understanding of the roles and responsibilities of directors and Audit & Supervisory Board members.

Chapter 6 Establishment, Revision, and Abolition

The Executive Meeting decides on the establishment, revision, and abolition of this basic policy.

Appendix 1

Independence Criteria for Independent Outside Officers

In accordance with the independence criteria of the stock exchange on which the Company is listed, the Company deems outside directors and outside Audit & Supervisory Board members (hereinafter, collectively referred to as “outside officers”) as defined in the Companies Act and candidates for outside officer to be independent when none of the following 1 through 13 apply.

- A person executing business of the Company and/or its subsidiaries (hereinafter, collectively referred to as “the Group”) (Note 1);

- A major shareholder of the Company (Note 2);

- A person who is a major supplier of the Group or a person executing business of such a company (Note 3);

- A person who is a major client of the Group or a person executing business of such a client (Note 4);

- A person executing business of a principal lender of the Group (Note 5);

- A person executing business of a company or other entity in which the Group owns 10% or more of the voting rights;

- A certified public accountant who is an accounting auditor of the Group and belongs to an auditing corporation;

- A consultant, accountant, tax accountant, lawyer, judicial scrivener, patent attorney, or other expert who receives a significant amount (Note 6) of money or other assets from the Group;

- A person who receives a significant amount (Note 6) of donations from the Group;

- A person executing business of another company with which the person has a relationship of mutual appointment (Note 7);

- A person whose close relative (Note 8) is in a key position (Note 9) in the case of any of 1 through 10 above;

- A person to whom any of 2 through 11 above applied in the past three years;

- Notwithstanding the provisions of each of the preceding items, a person deemed to have particular circumstances that could give rise to a conflict of interest with the Company.

End

- Note 1: Refers to a current executive director, corporate officer, executive officer or other equivalent person and employee (referred to collectively as “business executive” in these criteria) and a business executive who served at the Group at any time in the past 10 years (if the person was a non-executive director or Audit & Supervisory Board member at any time in past 10 years, the ten years prior to being appointed to these non-executive positions)

- Note 2: Major shareholder refers to a person who owns 10% or more of total voting rights directly or indirectly or a Business Executive of a major shareholder

- Note 3: Major supplier refers to a person who received payment of an amount from the Company equivalent to no less than 2% of the person’s annual consolidated net sales in the most recent business year

- Note 4: Major client of the Group refers to a person who made payment to the Company of an amount equivalent to no less than 2% of the Company’s annual consolidated net sales in the most recent business year

- Note 5: Principal lender refers to a financial institution from which the Group borrows when outstanding loans exceed 2% of the Group’s consolidated net assets at the end of the Company’s business year

- Note 6: A significant amount refers to an annual average over the past three business years of more than JPY10 million in the case of individuals, or more than 2% of the consolidated net sales or total income of the organization in the case of corporations, partnerships and other organizations

- Note 7: Refers to a relationship in which a business executive of the Group is an outside officer of another company, and a business executive of the said other company is an outside officer of the Company

- Note 8: A close relative refers to a spouse or a relative within the second degree of kinship

- Note 9: A person in a key position refers to a director, corporate officer, executive officer, or a senior manager at the level of general manager or above

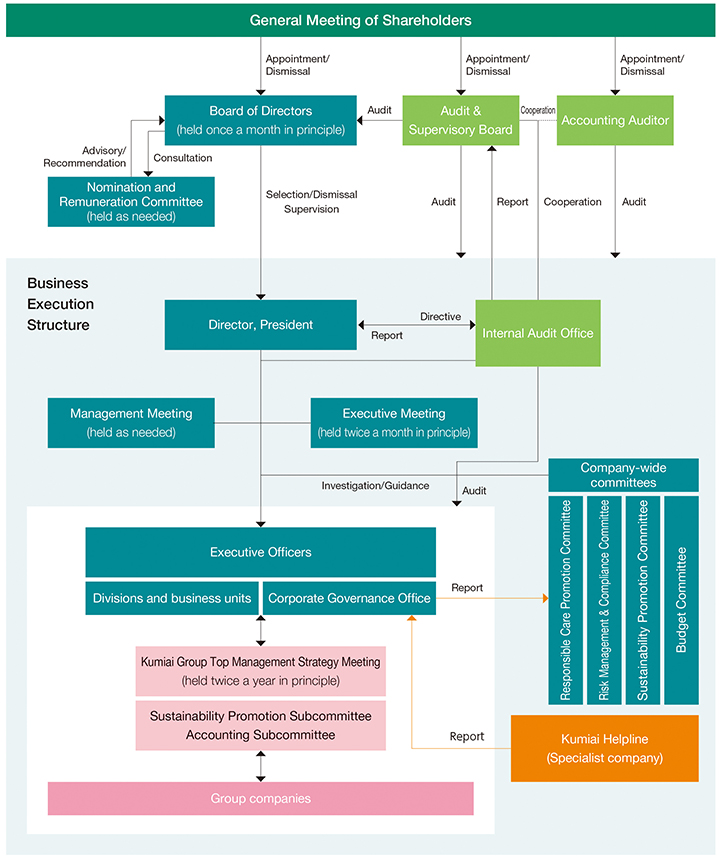

Corporate Governance Framework

Kumiai has adopted an Audit & Supervisory Board as the corporate governance framework. We have established a “Board of Directors,” “Management Meetings,” and “Executive Meetings,” and employ a corporate governance framework based on their respective decisions and discussions. We established the roles of the Board of Directors, focusing on decisionmaking related to management policies, and supervision of business execution in order to clarify the different responsibilities of management functions and business execution, and to enhance business execution functions and speed up the decision-making process. Kumiai is working to strengthen the auditing function of business execution by having a full-time Audit & Supervisory Board Member (Independent outside corporate auditor) attend other important internal meetings in addition to the Board of Directors, the Management Meetings, and Executive Meetings. The Board of Directors, Management Meetings, and Executive Meetings operate within the scope of their respective criteria based on internal regulations for making decisions, and we have determined that the system is functioning properly as a management check function including the execution of business based on made decisions.

Board of Directors

The Board of Directors is chaired by the President and Representative Director, and is comprised of nine Directors (including three Outside Directors), and meetings are generally held once a month where management policies and important management mater are determined, and business execution is supervised. At Board of Directors, four Audit & Supervisory Board Members are also present in order to strengthen management check functions, and they express their opinions as needed. We also have appointed a Nomination and Remuneration Committee under the Board of Directors for strengthening the independence, objectivity, and accountability of Board of Director functions in regards to nomination and remuneration of directors.

Management Meetings

Management Meetings are chaired by the President and Representative Director and are attended by six full-time Directors and three Managing Executive Officers. These are held as needed for discussing important management strategies and business operations. A full-time Audit & Supervisory Board Member also attends these meetings.

Executive Meetings

Executive Meetings are chaired by the President and Representative Director and are attended by six full-time Directors and ten Executive Officers. These are principally held twice a month for making decisions related to business operations. A full-time Audit & Supervisory Board Member also attends these meetings.

Audit & Supervisory Board

The Audit & Supervisory Board is chaired by a full-time Audit & Supervisory Board Member and is comprised of four Audit & Supervisory Board Members. They perform audits on the fulfillment of duties by Directors from an independent perspective based on audit policies and the audit plan established by the Audit & Supervisory Board.

Others

Meetings are also held for the “Budget Committee,” “Sustainability Promotion Committee,” “Risk Management & Compliance Committee,” and “Responsible Care Promotion Committee,” which are responsible for corporate governance, at least once a year and as needed in addition to the “Kumiai Group Top Management Strategy Meeting,” which is held twice a year. A full-time Audit & Supervisory Board Member attends all of these meetings. The Internal Audit Office carries out internal audits on the status of compliance with laws and regulations, and optimization of business activities, etc., from an independent perspective, and gives specific advice for improving business operations

Executives

Skills Matrix

| Corporate Management |

ESG Sustainability |

Legal /RiskManagement /Compliance |

Financial strategy Capital strategy |

Global Experience |

R&D Technologies |

|

|---|---|---|---|---|---|---|

| Director | ||||||

| TAKAGI Makoto |

● | ● | ● | |||

| UCHIDOI Toshiharu |

● | ● | 〇 | |||

| YOSHIMURA Takumi |

● | ● | 〇 | |||

| OKAWA Tetsuo |

〇 | ● | ● | |||

| IKAWA Teruhiko |

〇 | ● | ● | |||

| YOKOYAMA Masaru |

〇 | ● | ● | |||

| Outside Director | ||||||

| NISHIO Tadahisa |

● | 〇 | ● | |||

| IKEDA Kanji |

● | ● | 〇 | |||

| YAMANASHI Chisato |

〇 | ● | ● | |||

| Outside Audit & Supervisory Board Member | ||||||

| TANEDA Kohei |

〇 | ● | ● | |||

| YAMADA Masakazu |

● | 〇 | ● | |||

| SUKEGAWA Ryuji |

● | ● | 〇 | |||

| SHIRATORI Miwako |

● | 〇 | ● | |||

Evaluating the Effectiveness of the Board of Directors

Kumiai analyzes and evaluates the effectiveness of the Board of Directors once a year in order to improve its functions.

In the fiscal year ended October 2022, we conducted a survey for all Directors and Audit & Supervisory Board Members, which was overseen by an outside consultant. Results were then discussed at the Board of Directors, and then the effectiveness of the Board of Directors was analyzed and evaluated. We confirmed that the Board of Directors is operating properly and is effective. At the same time, certain items came to light related to the Board of Directors operations that require improvement, and we will continue with initiatives to improve these.

Evaluation Process

Evaluations are conducted using a survey that combines a 5-point evaluation with descriptive answers that target all Directors and Audit & Supervisory Board Members. The Board of Directors met on December 14, 2022 to review the results of the survey and to discuss issues and response measures.

Survey Items

The survey contained a total of 26 questions sorted into five main categories.

- Composition and operation of directors

- Management strategies and business strategies

- Corporate ethics and risk management

- Performance monitoring, and management evaluation and remunerations

- Dialog with shareholders

Evaluation

According to the results of the effectiveness evaluation for FY2022, it was confirmed that the Board of Directors is effective as a whole. Regarding the composition of the Directors, diversity such as appointing female Directors and internationality were pointed out as issues. It was also confirmed that the environment for discussions at Board of Directors was improved, resulting in more detailed reports being made, and it especially became easier to share inhouse information with Outside Directors. We will improve the effectiveness of the Board of Directors through honest exchange of opinions in order to have meaning discussions

Remunerations for Directors

The remuneration system is designed to function as an incentive for Directors to continuously improve Kumiai’s corporate value. It is the basic policy of Kumiai to set an appropriate level based on the responsibilities of each job when determining remunerations for individual Directors. Remunerations for Directors include monetary reward and non-monetary reward (transfer restricted stock remuneration). Transfer restricted stock remuneration is given to Directors who are not Outside Directors.

Monetary reward for Directors is determined based on a comprehensive consideration of each Director’s position, responsibilities, contribution to management, and consolidated performance.

Transfer restricted stock remuneration for Directors (excluding Outside Directors) is set to a certain percentage of monetary reward. The amount for transfer restricted stock remuneration is within the range for transfer restricted stock remuneration that has been approved at the General Meeting of Shareholders.

The remuneration amount for Directors and the ratio of monetary reward to transfer restricted stock remuneration are determined after a comprehensive consideration of items such as the economic environment, market environment, and business performance within the framework of the approval given in advance at the General Meeting of Shareholders. It is determined by the Representative Director selected by the Board of Directors after deliberation and reporting by the Nomination and Remuneration Committee, which is an advisory body to the Board of Directors and is comprised mostly of Outside Directors.